Civil Service Subsistence Rates Updated: What Employers Need to Know in 2025

Civil Service Subsistence Rates Updated: What Employers Need to Know in 2025

From 29 January 2025, the civil service subsistence rates have been revised. These updated rates are essential for employers who reimburse travel and subsistence expenses using the civil service flat rate model.

Employers may reimburse employees on a tax-free basis for qualifying expenses incurred while performing their duties, provided certain conditions are met. It’s important to ensure compliance, particularly under the Enhanced Reporting Requirements (ERR) regime. Below is a summary of the key changes and the current applicable rates:

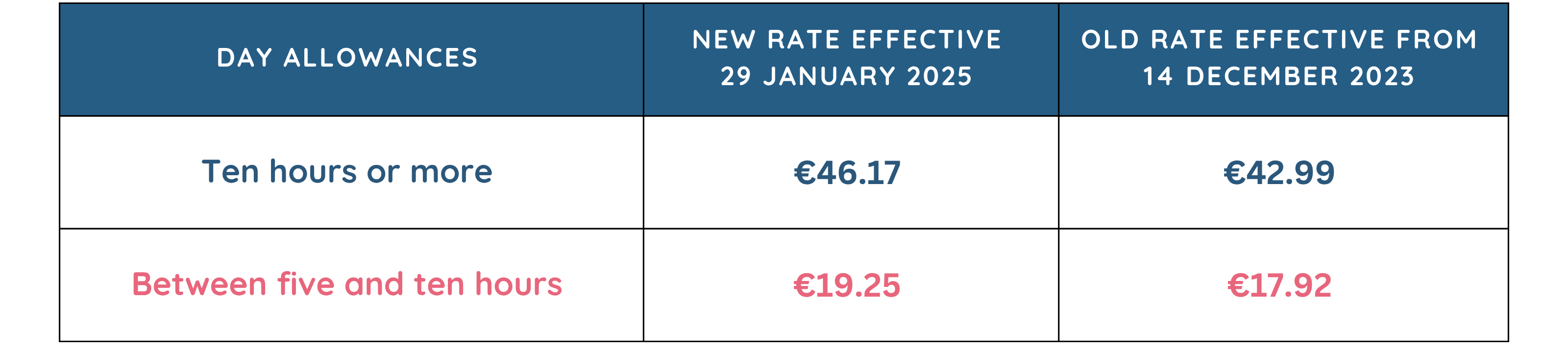

Day Allowances:

Note: The assignment must be outside 8km of the employee’s home and normal place of work. A day and overnight allowance may both be claimed only if the employee works five hours or more on the following day.

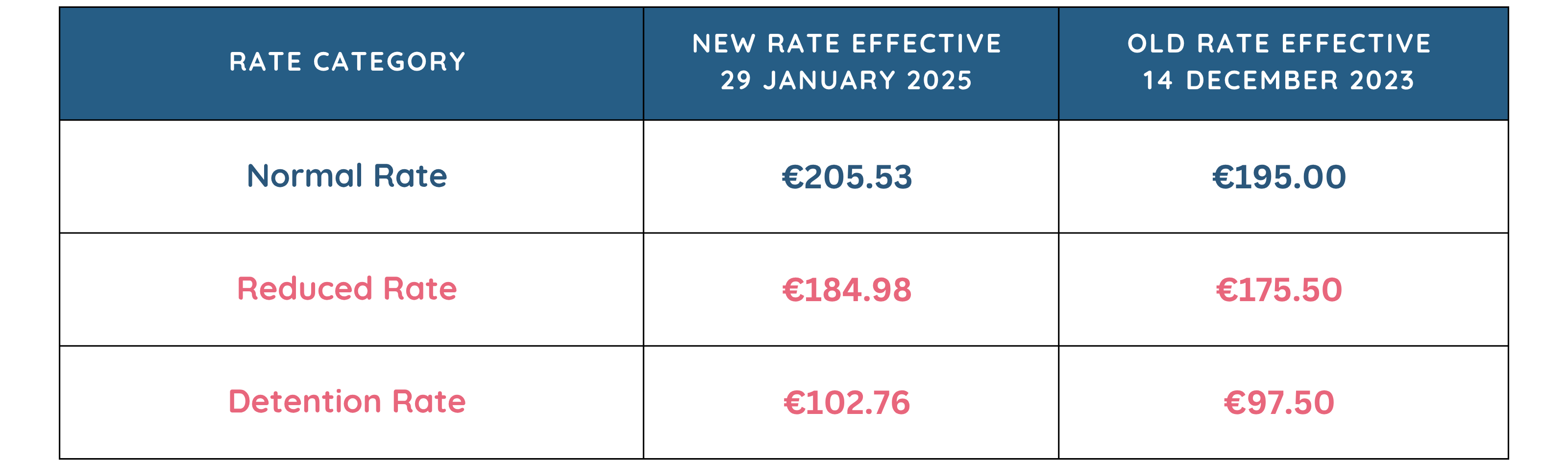

Overnight Rates:

The overnight allowance applies to assignments of up to 24 hours and must be at least 100km from both home and normal work location.

The overnight allowance applies to assignments of up to 24 hours and must be at least 100km from both home and normal work location.

Assignment Duration Guidance:

-

Normal rate: up to 14 nights

-

Reduced rate: next 14 nights

-

Detention rate: following 28 nights

-

For periods exceeding 56 nights, an application must be made to Revenue.

-

Subsistence at any one location is capped at six months.

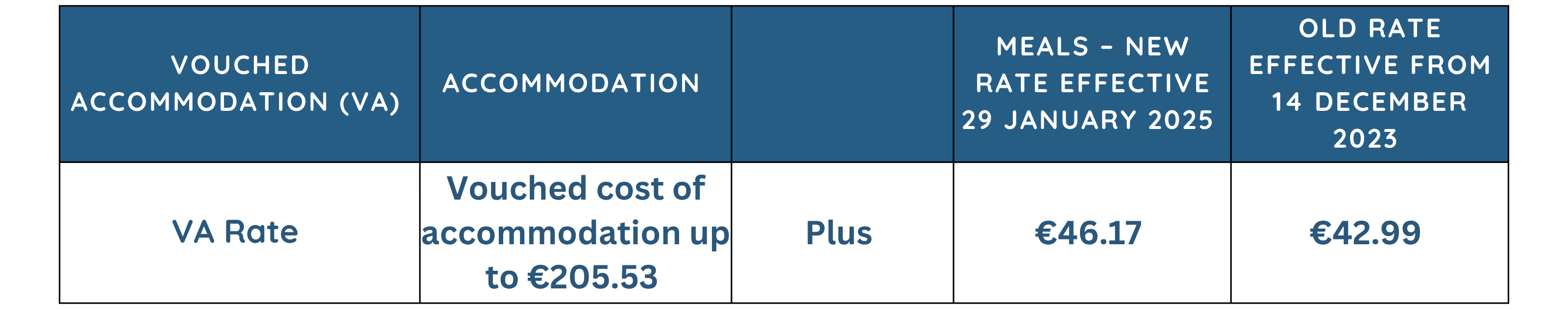

Vouched Accommodation (VA) Rate for Dublin

A Vouched Accommodation (VA) rate continues to apply where employees encounter difficulty sourcing suitable accommodation in Dublin within the standard overnight rate.

In such cases, the VA rate will remain the vouched cost of accommodation (up to €205.53), plus €46.17 to cover meals (10-hour rate).

Motor Travel:

Motor Travel:

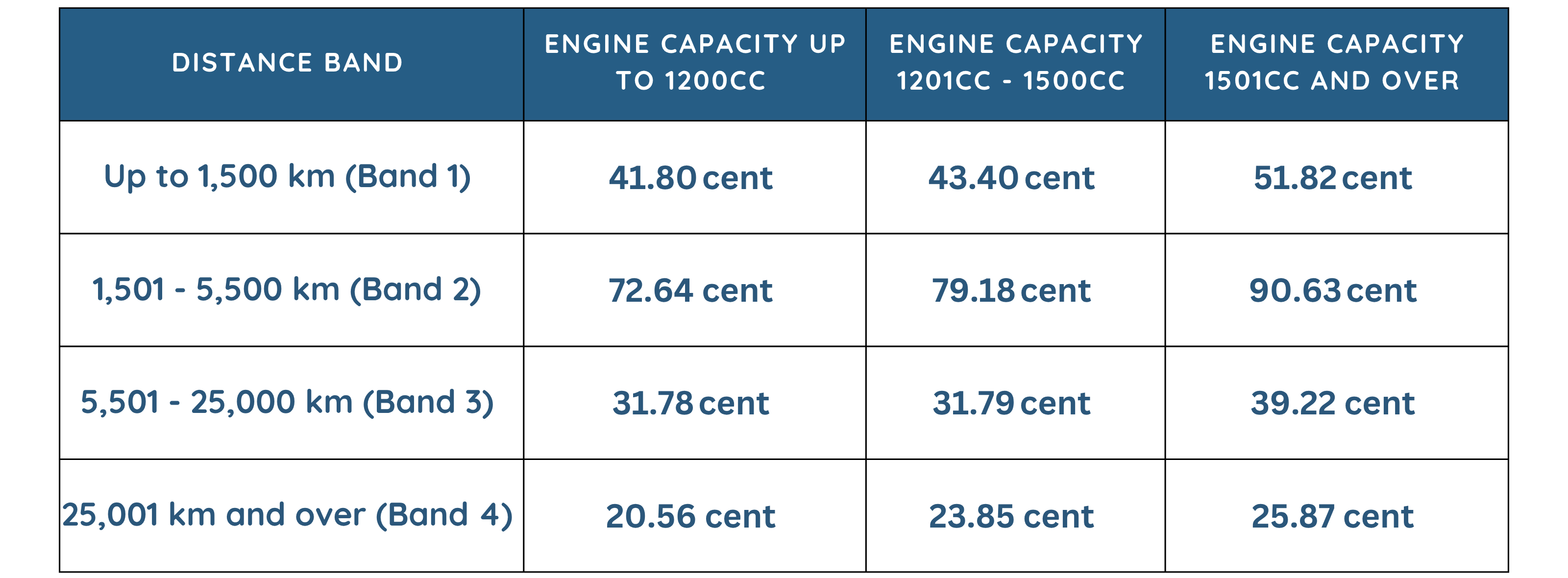

The motor travel rates in effect since 1 September 2022 are unchanged.

Mileage claims made in respect of journeys carried out in electric vehicles should use the rates applicable to engine capacity 1201cc–1500cc, as set out in the motor travel table.

Enhanced Reporting Requirements (ERR)

Remember, the reimbursement of travel and subsistence on a tax-free basis must comply with ERR obligations. Proper records and timely reporting to Revenue are essential.

Contact us:

If you have any questions about these updated rates or would like to ensure your expense policies are compliant, don’t hesitate to get in touch with the Gallagher Keane team.

Contact us today to discuss how we can support your finance function.