Pension Relief

Pension Relief

If you’re a member of an approved pension scheme, you’re eligible for income tax relief on your contributions to the scheme. It’s important to note that income tax is applicable when you receive your pension income.

The rate of tax relief on your pension contributions is determined by your highest rate of income tax, commonly known as the marginal rate.

Qualifying Rules for Tax Relief:

To benefit from tax relief, pension schemes must meet specific criteria, and there is a limit to the amount of relief you can claim. It’s important to be aware that there is no relief on PRSI (Pay Related Social Insurance) or the Universal Social Charge for employee pension contributions.

Limits on Tax Relief:

There’s a maximum limit on the overall value of your pension fund that qualifies for tax relief, known as the Standard Fund Threshold, which is currently set at €2 million. If your fund exceeds this limit, a tax rate of 40% will be applied to the excess when you draw down from the fund. Please note that a higher limit may apply if your fund exceeds €2 million on 1 January 2014; this is referred to as a Personal Fund Threshold.

Annual Limit on Contributions: Each year, there are restrictions on the number of pension contributions that qualify for relief, based on:

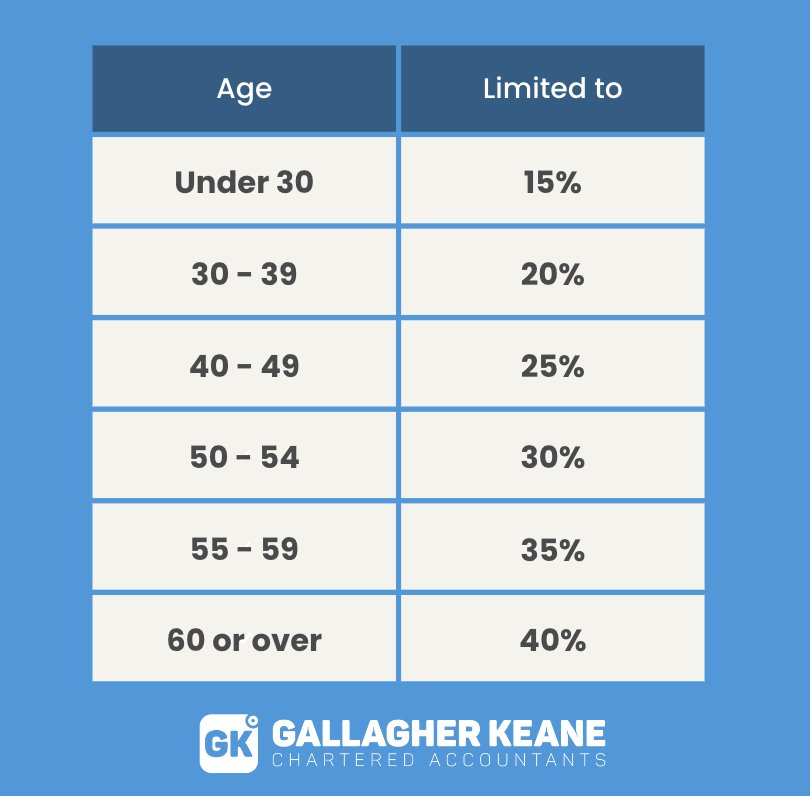

- A maximum percentage of your income, which varies depending on your age.

- A limit on the amount of income is considered when calculating the percentage.

- The maximum gross income taken into account for percentage calculation is €115,000. Here are the maximum percentage rates based on age:

If you’re a sports professional or retire earlier than the norm, you can claim tax relief on 30% of your net relevant earnings, regardless of your age.

Multiple Sources of Income: If you have more than one source of income, tax relief is only applicable to the income from which contributions are made.

Tax Relief on Lump Sums at Retirement:

Upon retirement, you can typically receive a portion of your pension fund as a tax-free lump sum. The amount you can take depends on your pension plan type and any previous tax-free lump sums received from other plans. There is a maximum limit of €200,000 on the total amount of tax-free retirement lump sums you can receive. Lump sum payments are subject to the following tax rates:

- Up to €200,000: 0%

- €200,001– €500,000: 20%

- Over €500,000: Taxpayer’s marginal rate

The maximum tax-free lump sum payment from an occupational pension is 1.5 times your final salary, contingent on a specific number of years of service. For Personal Retirement Savings Accounts (PRSAs) or Retirement Annuity Contracts (RACs), the maximum tax-free lump sum is 25% of the fund.

How to Apply:

Typically, your employer deducts pension contributions directly from your salary and will provide you with the applicable tax relief. In cases where your employer doesn’t deduct contributions, you can use myAccount to complete and file an income tax return.

If you’re self-employed, you can apply for tax relief on contributions through the Revenue Online Service (ROS).

For a step-by-step guide on claiming tax relief for pension contributions, Revenue has provided a helpful video resource. Click here to watch the video.

Get in Touch:

At Gallagher Keane Accountants, we’re here to assist you in making the most of your pension contributions and ensuring you benefit from available tax relief options. Feel free to reach out to us for personalised guidance and expert advice on managing your finances for a secure retirement.