Taxation of Restricted Shares – What you need to know

Restricted shares are a common form of employee compensation, providing employees with an opportunity to acquire company shares at a discounted price or as part of their remuneration package. Your employer may place a restriction on when you can dispose of your shares. This can include shares you acquired on the exercise of a share option, these shares are known as restricted shares.

If you have been awarded restricted shares, you are required to retain your shares for a fixed period of at least one year. You are not permitted to dispose of your shares during this period, except in limited circumstances (such as death or company reorganisation). You are deemed to have disposed of your shares if you:

- sell them

- transfer or pledge them to someone else

- use them as a guarantee for a loan.

Taxation of restricted shares:

Normally the amount chargeable to tax is the difference between:

- the market value of the shares at the date of acquisition

- and

- the price (if any) paid by you.

You must pay Income tax, USC and PRSI on the date of acquisition of the restricted shares.

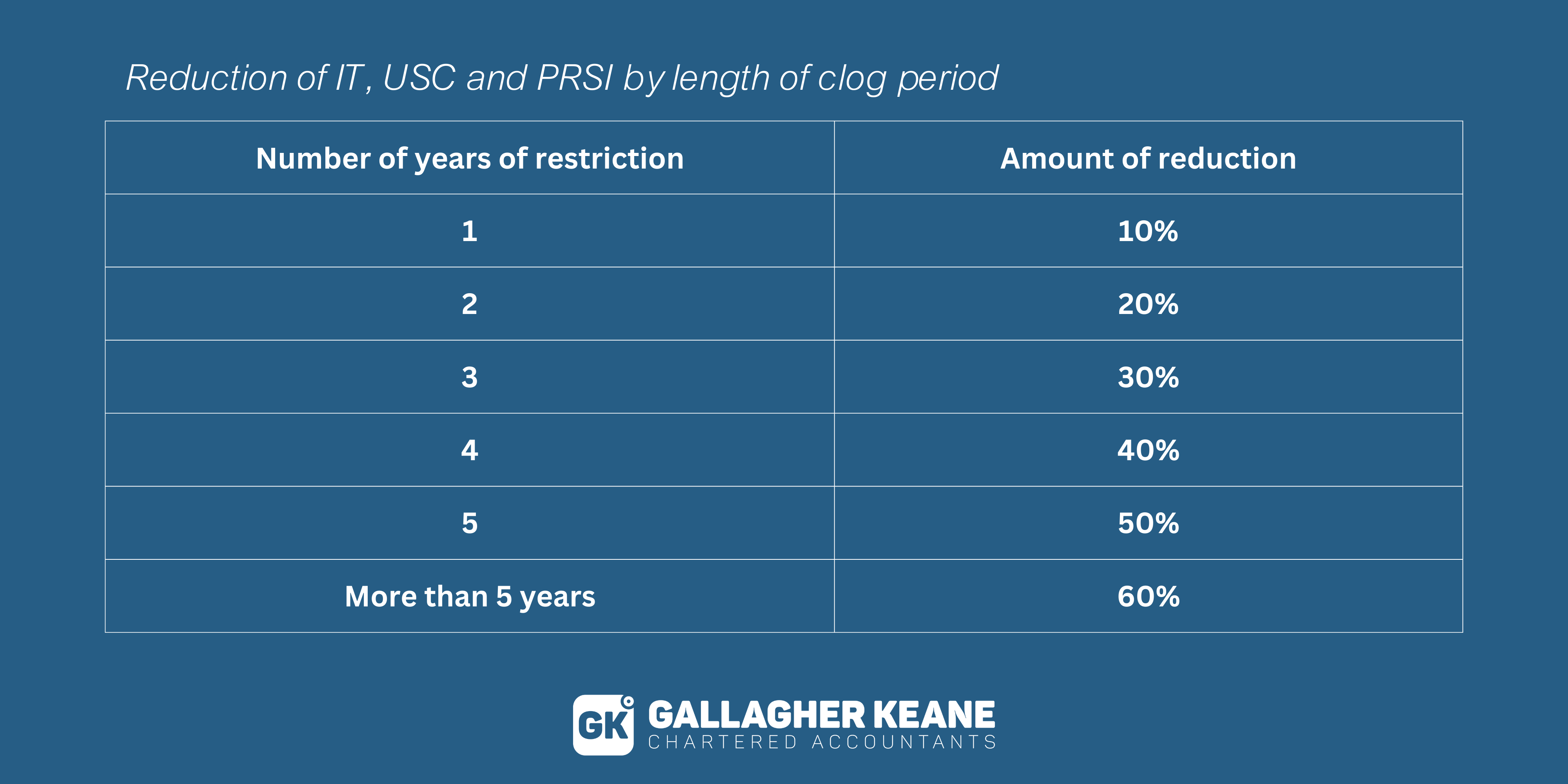

To take account of the restriction placed on you from disposing of your shares, the amount chargeable to tax is reduced. The amount of the reduction is between 10% and 60% depending on the length of the restriction period.

Your employer will make the necessary deductions through payroll and pay the tax directly to the Collector-General.

Change or removal of restriction:

The restriction may be changed or lifted before the end of the agreed restriction period. If this happens then the amount of IT, USC and PRSI you paid on the date the shares were awarded must be adjusted. The adjustment must take into account the actual period the restriction was in place. For example, if the restriction period is changed from four years to two years, the reduction rate changes from 40% to 20%.

Employers who processed the entitlements through Pay As You Earn (PAYE) payroll are required to make the adjustments through payroll:

- To the initial award

- or

- To the share allotment.

Your employer will not make these adjustments if the initial award or share allotment was not dealt with through payroll. In this case, you must inform Revenue of any additional IT, PRSI and USC due.

Capital Gains Tax (CGT)

If you dispose of your shares, you may be liable to CGT. You must report this disposal to Revenue, even if no tax is due. Your employer will not deduct any tax or report the disposal for you.

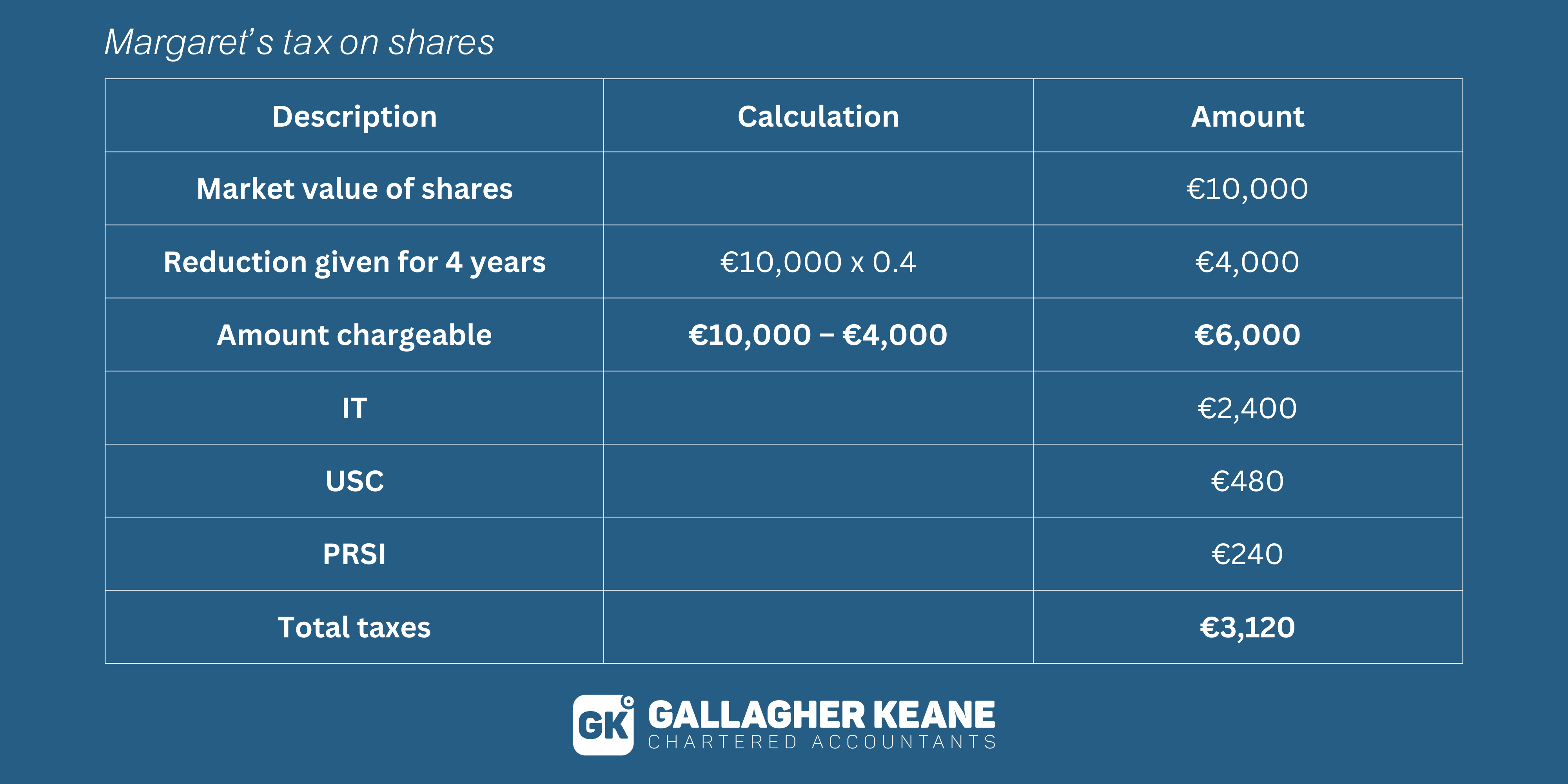

Example 1: Margaret was awarded 5,000 free shares by her employer on 1 January 2019. The market value of the shares at that time was €10,000 (€2 per share). Under the terms of the award, the shares cannot be disposed of for a period of four years. Margaret’s employer adds the value to her pay in the next payroll period. Margaret pays income tax at the higher rate of 40%.

If Margaret sells the shares after the restricted period for more than €10,000, she is liable to CGT.

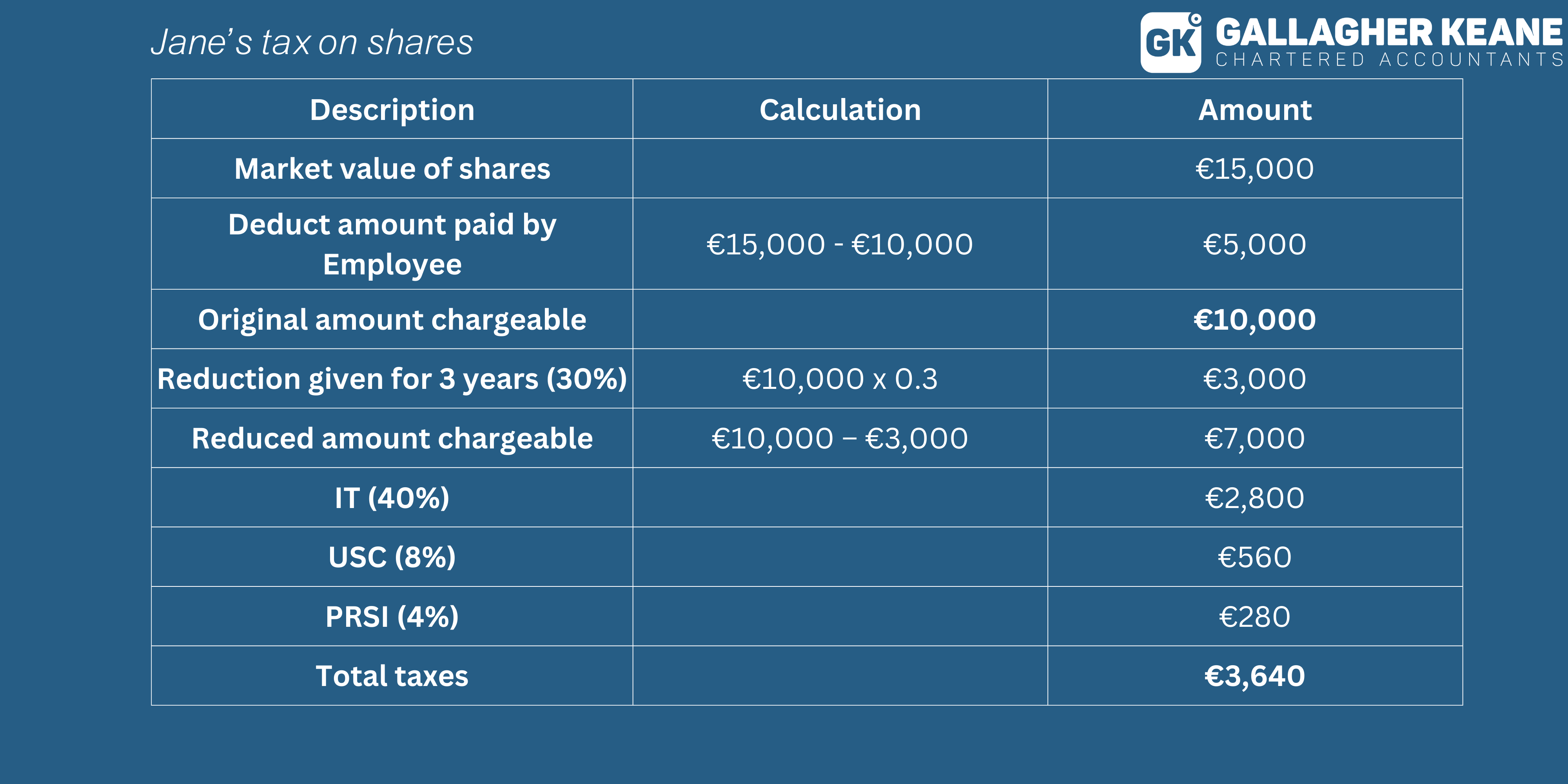

Example 2: Jane was awarded 5,000 shares by her employer on 1 January 2019. The market value of the shares at that time was €15,000 (€3 per share). Jane paid €5,000 for the shares (€1 per share).

Under the terms of the award, the shares cannot be disposed of for a period of three years. Jane’s employer adds the value to her pay in the next payroll period. Jane pays IT at the higher rate of 40%.

By familiarising yourself with the taxation of restricted shares in Ireland, you can navigate this aspect of employee compensation more confidently. Understanding our tax obligations empowers us to make the most of the opportunities presented by restricted shares while ensuring compliance with Irish tax laws.

Get in Touch:

Taxation can be complex, and it’s always advisable to consult with a qualified tax professional. If you are interested in finding out how Gallagher Keane can help you, please book a no-obligation call: