What is Principal Private Residence (PPR) Relief?

Principal Private Residence (PPR) Relief is a tax relief provided to individuals who sell their main residence or a property that has been their principal private residence. It aims to reduce or eliminate the Capital Gains Tax (CGT) liability that arises from the sale of the property. When you sell such a property, you will be exempt from Capital Gains Tax (CGT) under the following conditions:

Ownership and occupancy: The property must have been owned and occupied by the individual as their main residence for a period of time.

Length of ownership: There is no specific minimum ownership period required to claim PPR Relief. However, the relief may be restricted if the property was not owned for a significant period.

Size of the property: The relief also applies to the land surrounding the house, up to one acre (0.405 hectares).

Partial use: If only a portion of the property was used as the main residence, the relief may be restricted to the proportion used as the home.

Restriction if only part of your property was used as a home:

If only a part of your property was utilised as a residence, there are restrictions on the exemption you can claim. You are only eligible to claim for the specific part of the house that was used as your home. For instance, if half of your house was used for your business and the other half was your home, you can claim an exemption on only half of the chargeable gain.

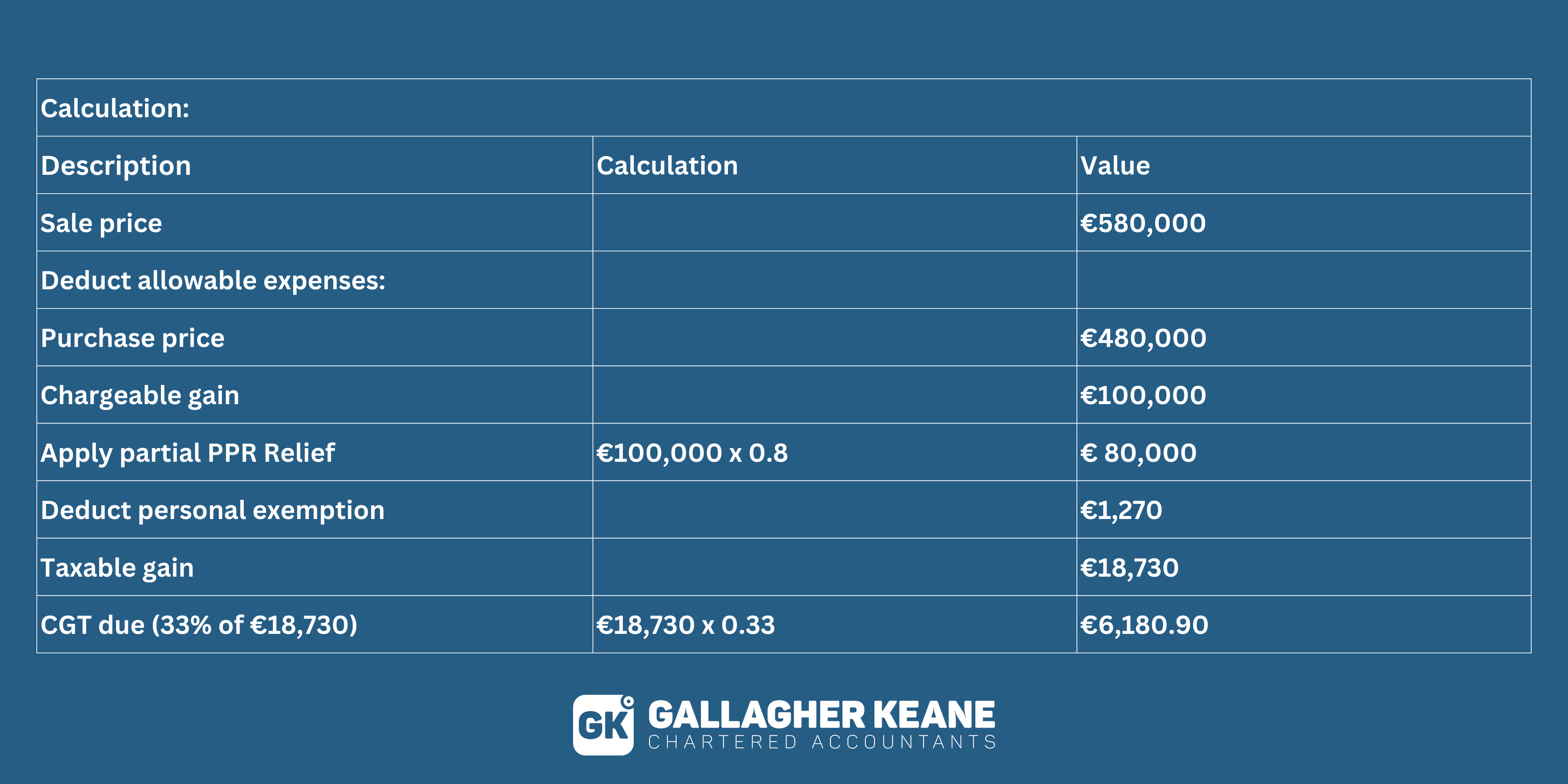

Example 1: John purchased a property in 2004 for €480,000, including associated costs. He subsequently sells the house in September 2018 for €580,000. Throughout his ownership, John used one-fifth of the house exclusively for his business purposes. As a result, he can only claim an exemption on four-fifths (80% or 0.8) of the proportion of the house that he utilized as his home.

Consequently, John will be required to pay Capital Gains Tax (CGT) on one-fifth (0.2) of his chargeable gain.

Restriction if you have not always lived in the property :You can only claim for the time you lived in the property.

Absences considered as living in the property

You will be considered to have lived in your property where:

- you could not live in the property because your employer required you to live elsewhere (up to a four-year maximum.)

- you had a job, all the duties of which were performed outside the Republic of Ireland

- your PPR remained unoccupied and you were either:

- receiving care in a hospital, nursing home or convalescent home

- resident in a retirement home on a fee-paying basis.

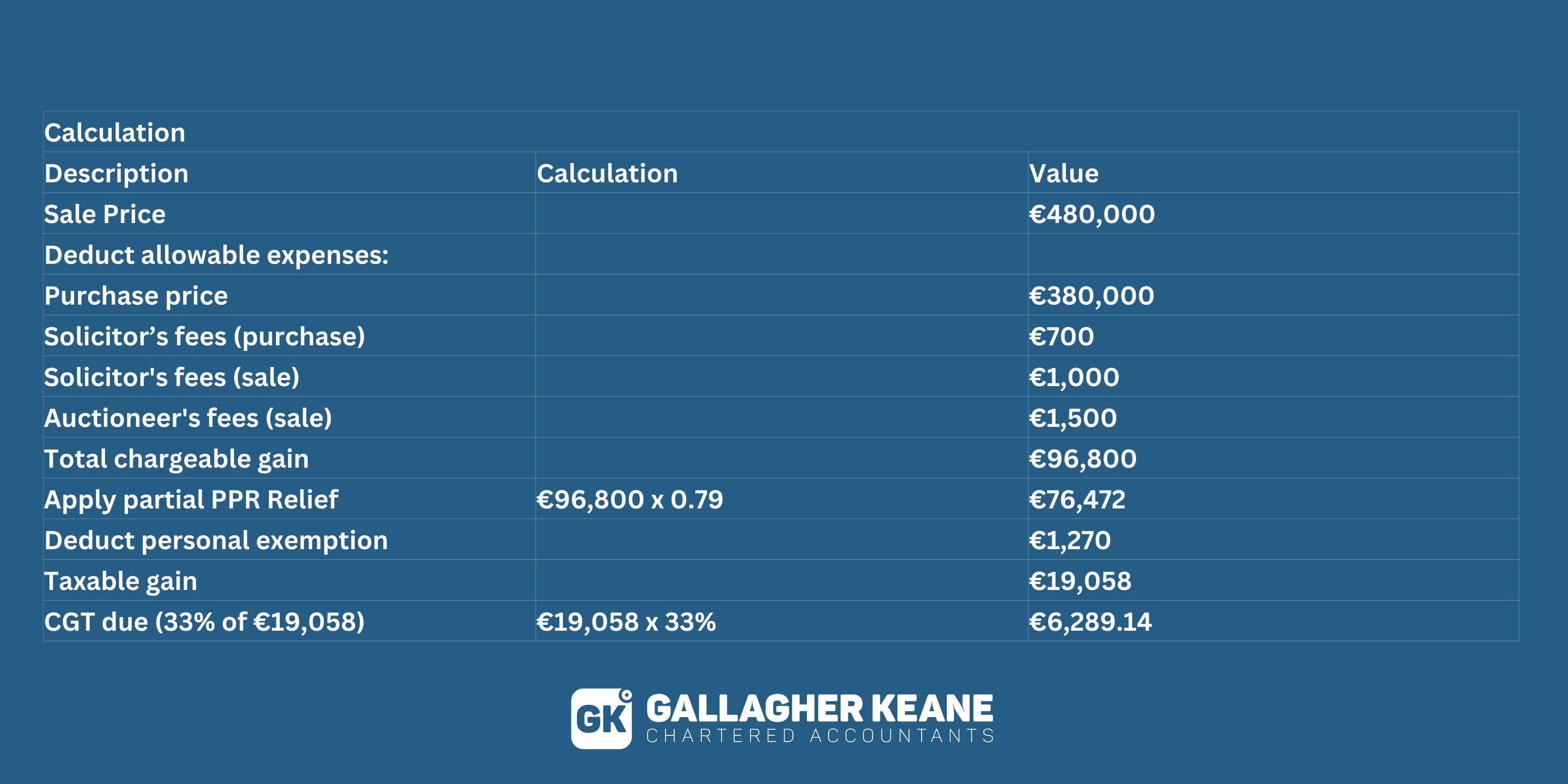

Example 2: Sandra purchased a house in June 2004 for €380,000, and it served as her Principal Private Residence (PPR) from June 2004 until June 2018. However, from June 2014 to June 2018, Sandra left the house to tenants. Eventually, she sold the house for €480,000. During the purchase of the house, Sandra incurred solicitor’s fees amounting to €700. When selling the property, she paid the solicitor’s fees of €1,000 and the auctioneer’s fees of €1,500.

Considering Sandra’s ownership span of 14 years, she can claim an exemption for the period in which the house was her PPR (10 years) and the last 12 months of ownership. Therefore, she is eligible for PPR relief for 11 out of the 14 years she owned the property. As a result, Sandra has an exemption on eleven-fourteenths (0.79) of the gain.

It’s worth noting that Sandra did not have any other gains in 2018.

Sandra paid her CGT before 15 December 2018. She filed her CGT return before 31 October 2019.

It’s important to note that PPR Relief in Ireland applies to the sale of the main residence, not investment properties or properties used solely for business purposes. The relief helps to reduce the tax burden for individuals who sell their primary residence, providing them with a financial benefit.

Get in Touch:

If you are interested in finding out how we can help your business, please book a no-obligation call: